How Stripe Is Paving the Way for Sustainability in Fintech

Photo Credit: Stripe

As financial technology platforms reshape global commerce, an important question is emerging: Can the tools that help power the digital economy also help heal the planet? With fintech innovations proliferating — from AI-powered risk analytics to blockchain-based payments — there’s a growing need to evaluate not just what these technologies can do for business, but how they impact the environment. At the intersection of innovation and climate responsibility stands Stripe, a financial infrastructure platform that is uniquely translating fintech momentum into climate action.

The Environmental Context: AI, Data, and Resource Strain

The conversation around sustainability in fintech isn’t abstract. It’s tethered to real environmental stressors. For instance, the rise of artificial intelligence — one of the most talked-about innovations across sectors — has significant environmental costs. AI models require enormous computational power. That power comes from sprawling data centers that generate massive heat, which in turn must be cooled — often with vast quantities of water. In the U.S. alone, data centers used 66 billion liters of water in 2023, a figure that reflects a rapid year-over-year rise linked to AI and cloud growth. As AI workloads scale, so too do these resource demands.

While AI may represent just one piece of the broader fintech landscape, these figures illustrate a broader truth: Digital infrastructure has environmental consequences — and the fintech community must consider them as part of its path forward.

Photo Credit: Hanwha Data Centers

Stripe’s Approach: Carbon Removal Through Stripe Climate

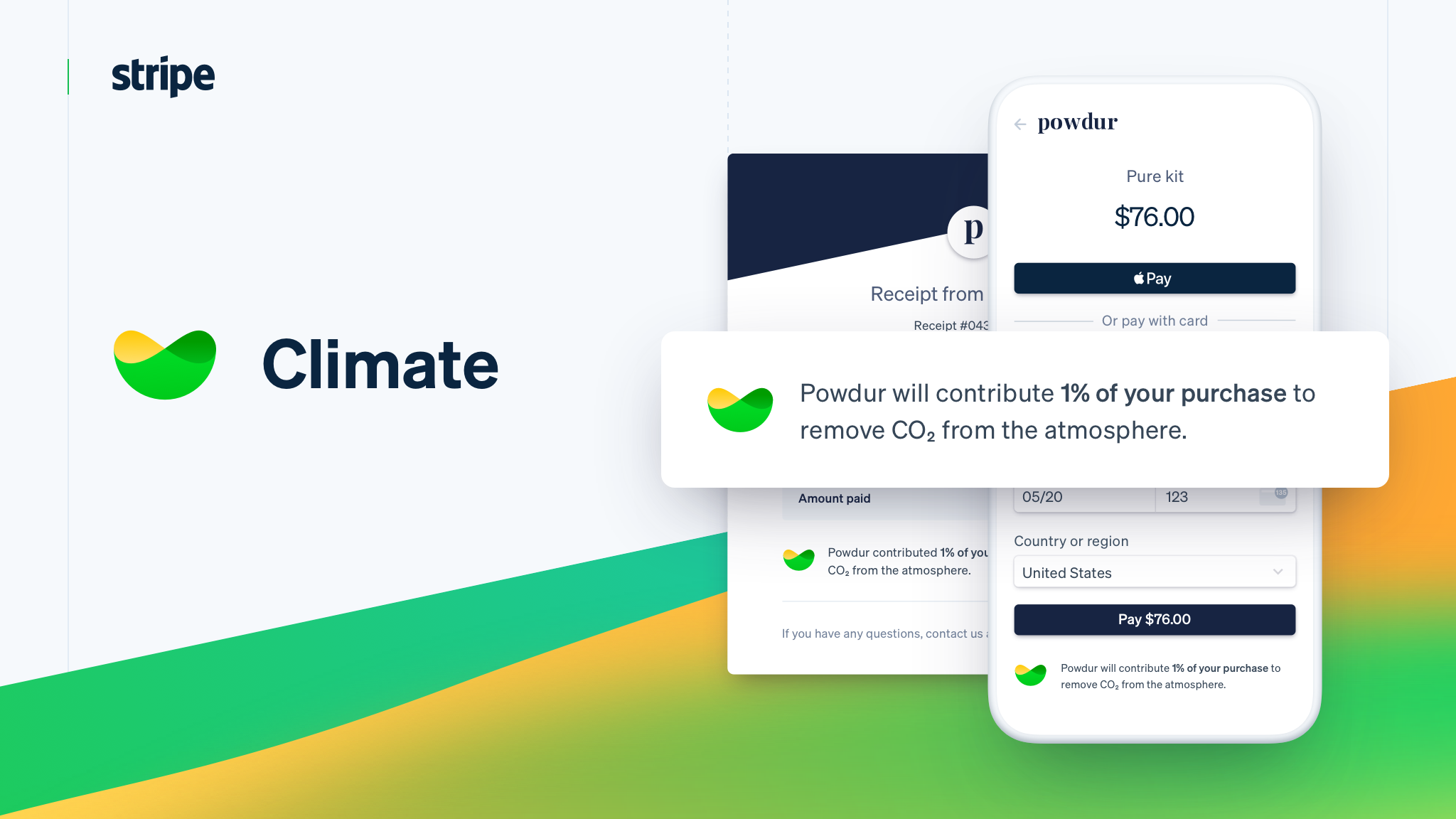

Stripe has taken steps to address climate challenges through initiatives like Stripe Climate, a program that helps businesses accelerate the development of permanent carbon removal technologies. As Stripe’s own climate page explains, the goal is simple but ambitious: make it easy for companies to contribute a portion of their revenue to fund carbon removal and help promising technologies scale.

Here’s how it works:

Fast onboarding: Businesses can sign up to contribute a fraction of revenue to carbon removal in just minutes.

Broad compatibility: Stripe Climate works with nearly any business model, from subscription services to usage-based billing.

Verified impact: Contributions fund vetted carbon removal projects through Frontier — an advance market commitment co-founded by Stripe and other tech leaders to help permanent carbon removal technologies mature.

Two flexible options:

Climate Commitments: Direct a percentage of revenue to help early-stage carbon removal companies bring solutions out of the lab.

Climate Orders: Pre-order a specific number of tons of carbon removal directly through the Stripe dashboard or API.

What makes Stripe’s strategy noteworthy is its pragmatic blend of business integration and climate ambition. Instead of requiring complex climate reporting or separate partnerships, Stripe embeds carbon removal into the moment companies already engage with Stripe — at checkout, on invoices, and via APIs.

Photo Credit: Compressors Unlimited

Tech + Fintech = A Role in Green Finance

Stripe’s climate work parallels broader trends in green fintech — the use of financial technology to support environmental goals like emissions reduction and carbon efficiency. Empirical research from China shows that green fintech significantly improves carbon emission efficiency, in part by driving innovation and leveraging advanced digital tools. However, researchers also note a paradox: as green fintech grows, its own digital carbon footprint — notably from data centers and extensive computation — can partially offset some sustainability gains.

The implication? Sustainability and technology must advance hand-in-hand. It’s not enough to build low-carbon financial products; the infrastructure that supports them — from cloud services to AI training — must also become more sustainable.

Stripe in the Real World: Corporate Climate Coalitions

Stripe isn’t operating alone. Recent reporting shows that Stripe, alongside Google and other tech leaders, backed a $44 million commitment to purchase carbon credits from NULIFE GreenTech — a company that converts biowaste into carbon-removing bio-oil. This initiative is part of Frontier’s broader $1 billion pledge to support carbon removal technologies by 2030.

These commitments position Stripe not only as a payment infrastructure provider but as a climate ally within fintech and tech more broadly.

What This Means for Fintech and Sustainability

Stripe’s work exemplifies how fintech companies can engage with environmental stewardship in three meaningful ways:

Embed climate action into core product flows — not as an add-on, but as an integrated option for businesses.

Support systemic solutions — like permanent carbon removal technologies that have long-term climate impact rather than short-lived offsets.

Collaborate with the broader tech ecosystem — demonstrating that climate innovation often requires coalition building across industries.

For content marketers, Stripe’s story offers a fulfilling narrative: a business platform that facilitates commerce while inviting its customers to participate in climate solutions. It reframes sustainability as not just a compliance checkbox, but a strategic, revenue-aligned choice that resonates with a values-driven audience.